affordable health insurance for dogs that prioritizes reliability and access

What affordability really means

Affordability is not just the lowest monthly premium. It's predictable, sustainable spending for care you can actually use. That means clear coverage, steady renewals, and support that answers fast when a vet says, "We need to run another test."

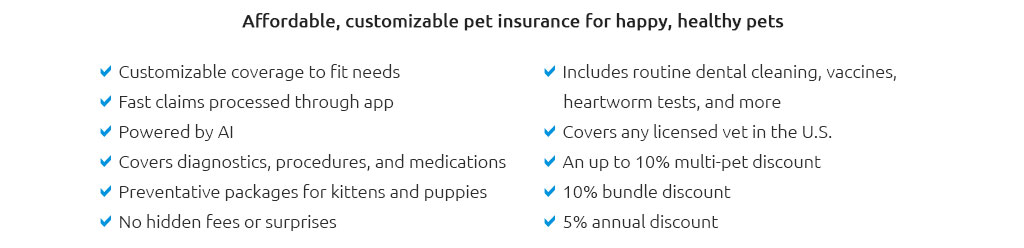

- Premium: the monthly cost. Low is good, but not if it sneaks in exclusions.

- Out-of-pocket rhythm: how the deductible, co-pay, and reimbursement rate interact during real visits.

- Access: any licensed vet, quick claims, and live help when you're worried at 2 a.m.

Core terms explained

- Deductible: what you pay before insurance contributes each policy year. Choose an amount you can cover in one paycheck.

- Reimbursement rate: percentage the plan pays after the deductible (e.g., 70% - 90%). Higher rates raise premiums but smooth big bills.

- Annual limit: maximum payout per year. It rarely matters - well, unless your dog develops a chronic condition or needs surgery, in which case it matters a lot.

- Waiting period: days before accident and illness benefits begin. Orthopedic issues may have extra windows.

- Pre-existing conditions: typically excluded; some curable issues may be reconsidered after a symptom-free period.

Reliability signals to check

- Transparent exclusions: exam fees, dental disease, behavioral care, and prescription food are common friction points. Clear lists beat glossy brochures.

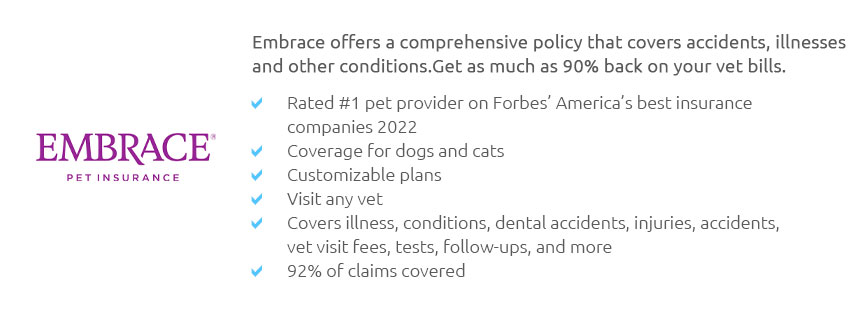

- Financial stability: long-standing carriers and consistent renewal behavior suggest claims will be paid when costs spike.

- Claims turnaround: look for estimates in business days and a track record that matches them.

- Veterinary flexibility: freedom to use any licensed vet; direct-pay options are helpful but not essential if reimbursements are fast.

A small real-world moment

On a rainy Tuesday, Lena scanned a $286 invoice for her beagle's ear infection in the clinic parking lot. The app pre-filled the claim; she paid the vet and a 70% reimbursement appeared four days later. Not dramatic - just steady help.

Cost drivers you can influence (and a few you can't)

- Age: premiums rise with age; enrolling earlier avoids late-stage exclusions and longer waiting periods for knees or hips.

- Breed: brachycephalic and large breeds often cost more due to airway, joint, or cardiac risks.

- Location: urban vet care is pricier; expect higher premiums and bigger savings from strong reimbursement.

- Deductible choice: higher deductible, lower premium - good if you can absorb a once-a-year hit.

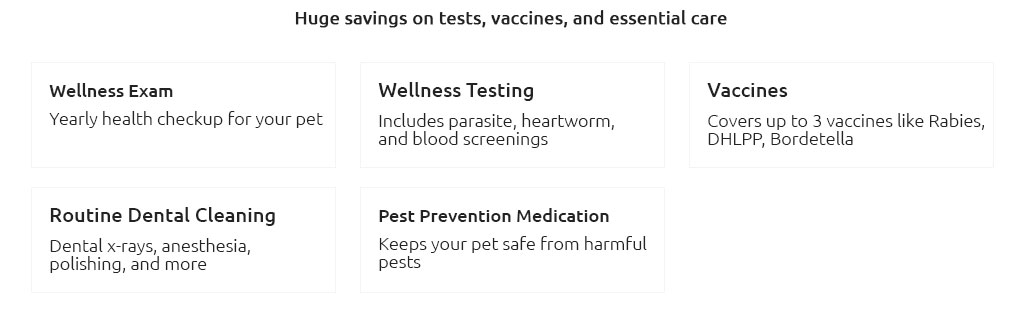

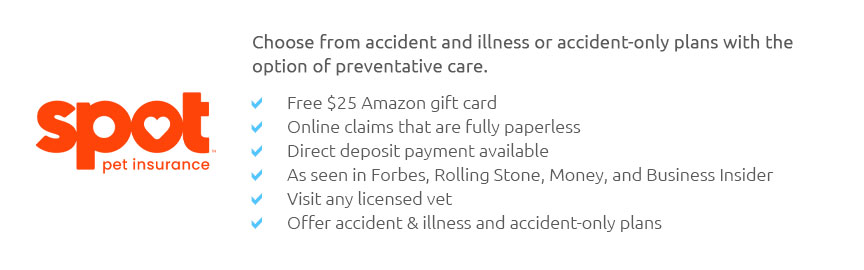

- Coverage scope: accident-only is cheapest; accident-and-illness fits most dogs; wellness add-ons can be convenient but aren't always cost-effective.

Simple path to a solid policy

- List non-negotiables: hereditary and chronic conditions covered, no per-condition caps, and exam fees if you want fewer surprises.

- Pick a deductible you can pay from cash, not credit.

- Choose the lowest reimbursement rate that still keeps emergency surgery survivable for your budget (often 70% - 80%).

- Read the sample policy and a sample explanation of benefits to see how claims are calculated.

- Confirm waiting periods and any orthopedic or bilateral condition clauses.

- After enrollment, test the process with a small claim to learn the workflow before a crisis.

Common gaps and gotchas

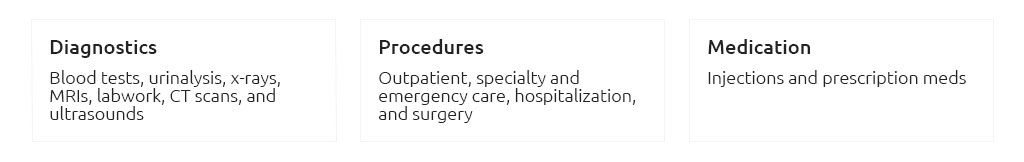

- Exam fees may be excluded; that adds up on diagnostic-heavy visits.

- Dental disease and behavioral therapy often require add-ons or are excluded.

- Prescription diets and supplements are usually not covered unless specifically listed.

- Bilateral clauses can exclude the second knee, hip, or eye if the first was treated pre-policy.

- Renewal increases happen; comparing at renewal is fine, but switching resets pre-existing condition clocks.

Accessibility matters, especially on hard days

Look for 24/7 tele-vet access, straightforward claim uploads, and responsive support in your language. The best coverage feels almost invisible - until it quietly pays a big bill. A savings fund helps too; it just doesn't scale against a $4,800 cruciate repair or a weekend hospitalization.

Quick number sketch

A mid-tier plan for a young mixed-breed in a mid-cost area might run $28 - $55 per month. With an $500 deductible and 80% reimbursement, a $1,200 gastroenteritis visit could cost about $660 out of pocket the first time (deductible plus your share), then less for follow-ups in the same policy year.

If you decide to wait

Build a dedicated vet fund, keep preventives current, and ask your clinic about payment plans or third-party financing. It's prudent - slightly - yet leaves you exposed to high-cost emergencies and exclusions later.

How to compare without getting overwhelmed

- Collect two quotes at the same deductible, then a third with a higher deductible to see price sensitivity.

- Read the exclusions section, not just coverage highlights.

- Favor consistent claims performance over flashy perks.

Bottom line

Prioritize reliability and accessibility, then pick a price that fits your monthly rhythm. The right affordable health insurance for dogs doesn't promise miracles; it simply shows up on the day you need it.